Happy Earth Day

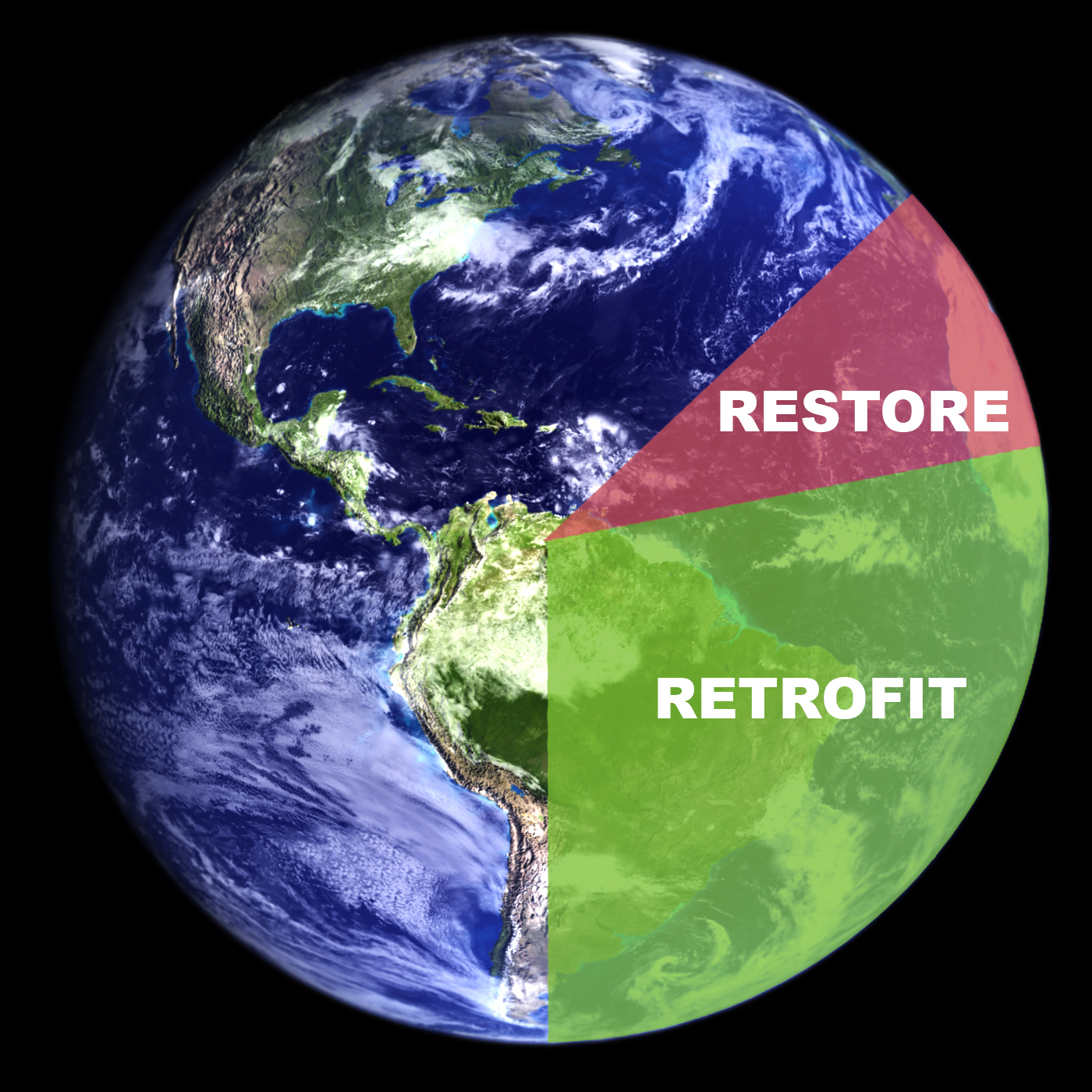

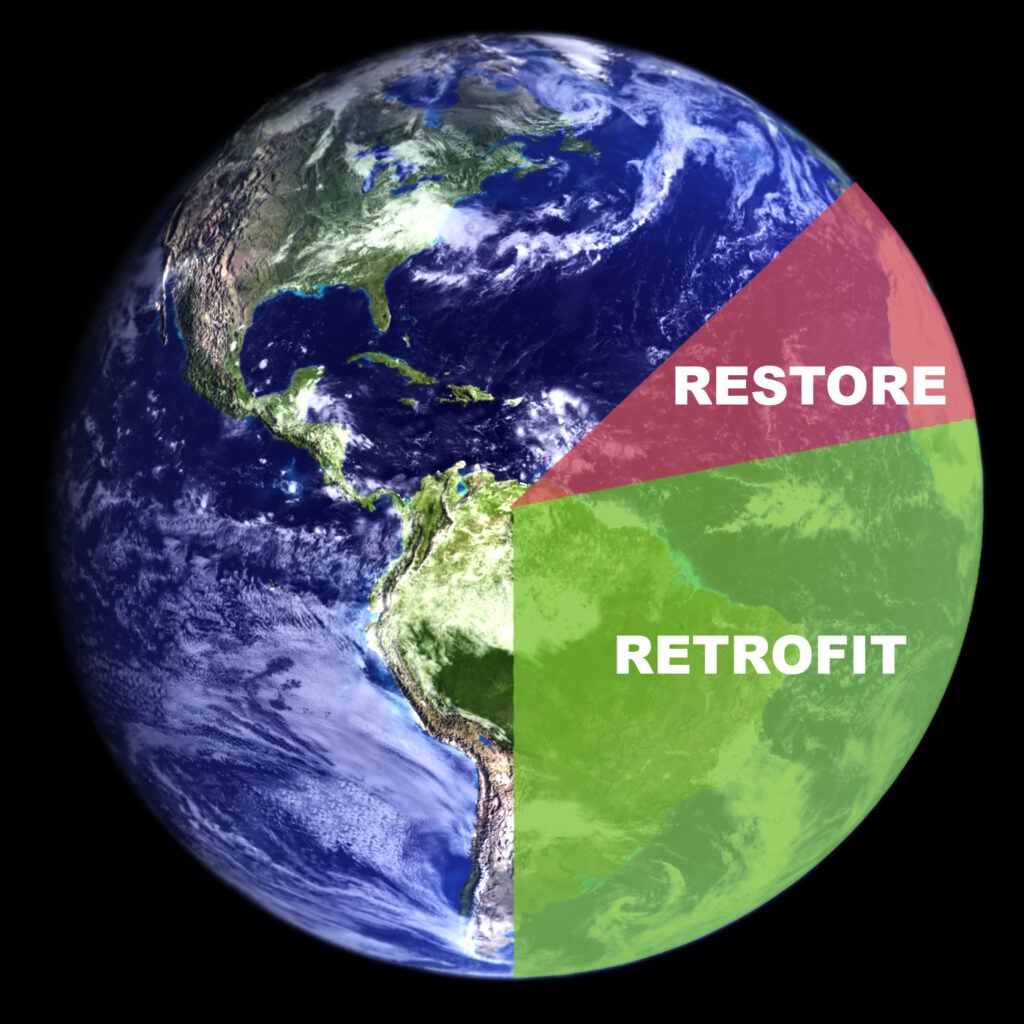

Happy Earth Day! Did you know that one of the most powerful ways to address climate change is to restore and retrofit our buildings? In March, 70 nations signed the UN-sponsored Declaration de Chaillot. This foundational document calls for global cooperation to address the 37% of the energy-related CO2 emissions that come from buildings and construction. This year, the first